Are we inching towards WW3?

Posted on | April 22, 2014 | 3 Comments

CHINA SEIZES JAPANESE SHIP Over Pre-World War II Debt

Category: Uncategorized

Comments

3 Responses to “Are we inching towards WW3?”

Leave a Reply

-

EVIDENCE AGAINST OBAMA — YouTube Indiana Trial of Obama !

EVIDENCE AGAINST OBAMA — Indiana Trial of Obama, 2nd Copy

Evidence on Barack Obama

Obama File with Exhibits

Affidavit of Paul Irey

Obama file Exhibits 1 - 7

Obama file Exhibit 8 - Part 1

Obama file Exhibit 8 - Part 2

Obama file Exhibits 9-13

Obama file Exhibits 14-21

Request for Docs under FOIA and Emergency Motion for Reconsideration

Exhibits sent to Inspector Generals and CongressPetition the White House to institute Edward Snowden, National Whistleblower – Patriots against Government Corruption Day

URGENT! PLEASE SIGN PETITION TO CONGRESS

OrlyTaitzEsq.com

OrlyTaitzEsq.comTAITZ REPORT

Official Facebook

Recent Posts

IMPORTANT NOTICES – PLEASE READ!

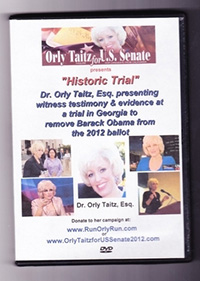

Historic DVD Now Available! DVD of the historic trial in GA and DVD of a historic testimony in NH, where evidence was provided showing Obama using a forged birth certificate and a stolen social security number. The DVDs are in a beautiful commemorative case with personal autographs from attorney Dr. Orly Taitz $22.50 each +$2.50 for shipping and handling.

---------

To order these DVDs, donate $25.00 by credit card on the website RunOrlyRun.com and email orly.taitz@gmail.com with you name and address. Or send a $25.00 check with your name and address to: Orly Taitz for US Senate 2012, 29839 Santa Margarita ste 100, RSM, CA 92688.

DVD of the historic trial in GA and DVD of a historic testimony in NH, where evidence was provided showing Obama using a forged birth certificate and a stolen social security number. The DVDs are in a beautiful commemorative case with personal autographs from attorney Dr. Orly Taitz $22.50 each +$2.50 for shipping and handling.

---------

To order these DVDs, donate $25.00 by credit card on the website RunOrlyRun.com and email orly.taitz@gmail.com with you name and address. Or send a $25.00 check with your name and address to: Orly Taitz for US Senate 2012, 29839 Santa Margarita ste 100, RSM, CA 92688.

Advertisement / Sponsors

29839 Sta Margarita Pkwy,

29839 Sta Margarita Pkwy,

Ste 100

Rancho Sta Margarita, CA 92688

orly.taitz @gmail. com

(949) 766-7687

--------------------------------------

Videography by Barbara Rosenfeld

Videography by Barbara Rosenfeld

--------------------------------------

Bumper Sticker

$9.99 thru PayPal--------------------------------------

--------------------------------------Orly Taitz Photo Collections

Pages

- #409755 (no title)

- …Defendant Obama defaulted in Grinols et al v Obama et al

- …Grinols Subpoenas

- ..Grinols Order, Summons, TRO, Complaint

- .Affidavit of Mike Zullo

- 1. Judd v Obama

- 2. Farrar v Obama

- 3. Taitz v Sebelius

- 4. Taitz v Indiana, IN Judge Orders Trial

- 5. Taitz v Astrue

- 6. Mississippi Filed Complaint Update

- 7. Taitz Walters v Sec of State Kansas

- Videos

- Video: Orly before NH Election Committee

April 22nd, 2014 @ 9:42 am

the 2 most incompetent boobs are running our country-both crooked politicians who put party loyalty over honesty & America

April 22nd, 2014 @ 11:13 am

OH PLEEZZ. The following is a re-posting of China’s debt to the U.S. remaining UNPAID!!!

*****************

It’s Time for China to Pay Its Debts to the United States

By Peter Huessy

Published August 26, 2011

FoxNews.com

Facebook873 Twitter177 Gplus30

Many people assume China has the U.S. over a barrel. The country buys so much of our debt—around $800 billion—that we cannot “rock the boat” when it comes to U.S. and China relations. That has meant not pressing the PRC “too hard” when it comes to North Korea, or Iran.

Just recently, a top Obama administration delegation visited the People’s Republic of China. While there, the Chinese were told not to worry about the U.S. paying its debts to the country — their investments in the U.S. were safe. True enough.

But, I was struck with the fact that the PRC, however, does not pay its debts to the U.S. Now, that may strike most Americans as a “You must be kidding story”. But in fact it is true. (BACKGROUND:

PayPal – The safer, easier way to pay online!

From 1900 to 1940, the Chinese Government issued millions of dollars in sovereign debt – most notably, a large tranche of £25,000,000 issued at 5% in 1913 set to mature in 1960. This massive bond funded the modernization of China’s infrastructure and was widely acquired at the time by governments, banks, and investors across the globe. However, in 1938 China defaulted on its “binding engagement upon the Government of the Republic of China and its Successors,” leaving millions of global creditors unpaid. In accordance with the terms of the bond, successor government doctrine, and accounting standards, the United States can and should hold China accountable to its obligations.

WHO HOLDS THE BONDS:

The Chinese bonds in question are held throughout the world by treasuries, banks, companies, and over 20,000 private U.S. investors – many of which are active in seeking remuneration. Critically, the U.S. Treasury and Departments of Justice and State are understood to hold substantial portions of this Chinese sovereign debt. These holdings have not been fully cataloged nor has the U.S. Government moved to hold China accountable for its debt obligations.

HOLDING CHINA ACCOUNTABLE:

China is eager to be recognized by the international trade and financial community as a market economy. However, in order to be regarded as a responsible and reliable participant in international commerce and finance, China must acknowledge and rectify its multiple transgressions against the United States and WTO:

–

VIOLATION OF SUCCESSOR GOVERNMENT DOCTRINE: It is well established, as a matter of international law, that a successor government is responsible for the payment of sovereign debt obligations of a predecessor government.1

–

WORLD TRADE ORGANIZATION VIOLATION: China’s refusal to honor its sovereign debt obligations violates its obligations as a member of the World Trade Organization – a membership that requires China to abide by accepted international legal norms, yet action has not been taken against China on this account.

–

AFFIRMATIVE CONCESSION OF OBLIGATION: The Peoples

Republic of China (PRC) has flouted the international community by refusing to pay this debt since 1938. However, the PRC made good on its British obligations in 1987 by paying over £20 million of its bond and property obligations in order to receive normalized access to the British markets in June of 1987.2 This affirmative accession should be applied to U.S. bond holdings equally.

–

SECURITIES AND EXCHANGE COMMISSION (SEC) VIOLATIONS: China and numerous state-owned and controlled Chinese enterprises (SOEs) participate in U.S. capital markets and constitute “issuers” under U.S. securities law yet omit substantial “material” information (i.e. selective debt default) that a reasonable investor would find to be important in determining whether to purchase the applicable securities.3

–

CHINA’S INCOMPLETE CREDIT RATING: The Nationally Recognized Statistical Rating Organizations (NRSROs) consistently accord artificially high ratings to long-term foreign currency debt of the Chinese Government and do not recognize China’s actual “selective default” rating. https://americanbondholdersfoundation.com/

The Nationally Recognized Statistical Rating Organizations (NRSROs) consistently accord artificially high ratings to long-term foreign currency debt of the Chinese Government and do not recognize China’s actual “selective default” rating. )

Many decades ago, China sold sovereign bonds worldwide to investors in many nations. They sold tens of thousands of these bonds on U.S. soil to American citizens on the recommendation of our government, indicating it was a solid investment.

Over the last sixty years, China has refused to pay to these bondholders either the principal or interest on these full faith and credit sovereign bonds. (To say nothing of the hundreds of billions also owed to U.S. artists from unpaid royalties on the more recent sale of pirated CD’s and videos, but that’s another story).

In 1987, threatened with being kept out of the British financial markets, China acknowledged the debt in owed from the sale of these exact same bonds to British investors. As part of the Great Britain-PRC agreement on Hong Kong, the PRC agreed to pay its debt to British citizens who owned these same bonds. By paying the British bondholders, but no other bond owners worldwide, including U.S. bondholders, China “selectively defaulted” on these bonds.

Standard and Poor’s claims it does not have to find the PRC in selective default because under their view of things, it is their first amendment right NOT to discuss certain things or take such things up. Well, not so fast, boys and girls.

Under the rules, they are granted a license by the Security and Exchange Commission (SEC) of the United States to be a nationally recognized statistical rating organization (NRSRO), a charter to assess the risk of investing in sovereign and corporate debt, stocks, or bonds. The “selective default” of the PRC must be acknowledged,in that the metrics used by the NRSRO organizations that they themselves have promised to follow as part of their license agreement includes just such a requirement.

Now if China was found in selective default, this would cause the PRC to have to pay considerably more to finance its debt than it does now. Billions more.

But because everyone thinks the PRC is the strong economic horse, S&P fudges this issue big time and does a disservice to the American people. It is as if you could pay a credit agency to write-up your credit score according to your own rules! Well… wouldn’t that be nice?

Ironically, with the fall of Saddam Hussein’s government in Iraq, the PRC insisted at the United Nations that any successor government in Iraq must be held to pay its debts, including debts to China. The U.N. approved.

Under international law as it has been understood for centuries, successor governments, no matter the circumstances of the establishment of a new government, whether by revolution or civil war, must pay the sovereign debt incurred by its predecessor. But currently, the People’s Republic of China owes a debt of over $750 billion to American citizens who are holding these full faith and credit sovereign bonds (many of them denominated in gold) sold to them by the Republic of China. Worldwide, the debt China owes to all bondholders is estimated to be several trillion dollars. The debt owed to the American people should be paid. The U.S. government could dollar for dollar offset bond interest we owe China with interest, principal and penalties China owes us.

That would be $750 billion. Split 10 to 1, the U.S. taxpayer saves $700 billion in debt payments and the bond holders could receive the balance. As part of the deal, each state could receive badly needed investment funds as well.[ABF Charities, a 501(c)3 organization devoted to humanitarian projects across all of the United States could distribute these funds]

And we could contribute significantly over a period of years to reduced U.S. debt. That could even be part of the upcoming budget and debt agreement, paid down over a period of years.

But as Michael Auslin of the American Enterprise Institute writes in The National Review, “Beijing’s plan since the early 1980s has been clear: Get strong. But in its success, China has developed the idea that the world’s rules don’t apply to it.” And I might add, when called to account for its behavior, it throws geostrategic temper tantrums.

Auslin suggests we imagine a China that protects U.S. intellectual property, pays its sovereign debts, upholds its contracts, and just for good measure, does not aim over a thousand missiles at Taiwan!

Yes, America pays its debts — as we have assured Beijing.

Now, let’s ensure we hold the PRC to account for its illegal behavior. Rules are there for a purpose. As my grandfather used to tell me, “Good fences make good neighbors.” China must pay its debts, too. All $750 billion!

Peter Huessy is President of GeoStrategic Analysis, a defense forecasting firm he founded in 1981.

April 22nd, 2014 @ 12:32 pm

Orly..

you can reach many like minded individuals… please support

https://conventionofstates.com/press-kit/

God bless.