Motion for stay/injunction in Taitz v Sebelius

Posted on | August 6, 2012 | 13 Comments

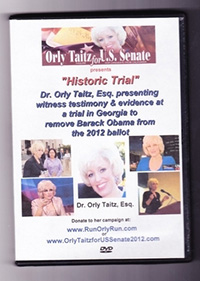

Dr. Orly Taitz, ESQ

29839 Santa Margarita, ste 100

Rancho Santa Margarita, CA 92688

Ph. 949-683-5411 fax 949-766-7603

Pro se plaintiff

IN THE US DISTRICT COURT FOR THE CENTRAL DISTRICT OF CALIFORNIA

DR. ORLY TAITZ, ESQ, PLAINTIFF ) CASE # SACV-12-1092 DMG (JC)

V ) ASSIGNED TO

KATHLEEN SEBELIUS ) TRIAL SCHEDULED ON

IN HER CAPACITY OF SECRETARY OF ) VIOLATION OF 14TH AMENDMENT

HEALTH AND HUMAN SERVICES, ) EQUAL PROTECTION RIGHTS,

et al. ) ESTABLISHMENT CLAUSE

DEFENDANTS ) ARTICLE 2, SEC 1 OF COSTITUTION ) INJUNCTIVE RELIEF, STAY

) DECLARATORY RELIEF

) RICO, PREDECATE CRIMES:

) FRAUD, AIDING AND ABETTING

) FORGERY AND UTTERING OF FORGED

) DOCUMENTS TO COMMIT ELECTIONS

) FRAUD

) 7TH AMENDMENT JURY DEMANDED

Motion for stay/ preliminary injunction

Plaintiff Pro Se Dr. Orly Taitz (hereinafter “Taitz”) hereby moves this Court to enter a stay/preliminary injunction to assessment of the penalty tax under PPACA against her. Plaintiffs asserts that such penalty tax violates Plaintiff’s constitutional and statutory rights for Free Exercise of Religion, Free Speech, Due process rights, and rights provided by RFRA. In support of this motion Plaintiff submits an accompanying brief and a proposed order.

Plaintiff contacted Michelle Bennett, ESQ, Trial attorney, U.S. Department of Justice, Civil Division Federal Programs Branch, 20 Massachssetts Ave, NW, Washington. DC 20001 (202-3058902). Plaintiff left a message for Ms. Bennett advising her that Plaintiff is scheduled to have a motion hearing on August 10, 2012, 10 am on a different motion in this case, and Plaintiff would like to have the motion at hand to be heard by the court at the same time. Defendants’ attorney was given a phone number to call back and advise in regards to the motion at hand.

Plaintiff requests oral argument on the motion to be conducted in conjunction with the motion hearing scheduled on August 10, 2012.

Respectfully submitted,

by/s/ Orly Taitz

Dr. Orly Taitz ESQ. Plaintiff Pro Se

Certificate of Service

I, Yulia Yun over 18 years old and not a party to this case, certify that the true and correct copy of the preceding document was served on the Defendant by first class mail

Signed

____________________________________________________

Yulia Yun

Dated

____________________________________________________

Dr. Orly Taitz, ESQ

29839 Santa Margarita, ste 100

Rancho Santa Margarita, CA 92688

Ph. 949-683-5411 fax 949-766-7603

Pro se plaintiff

IN THE US DISTRICT COURT FOR THE CENTRAL DISTRICT OF CALIFORNIA

DR. ORLY TAITZ, ESQ, PLAINTIFF ) CASE # SACV-12-1092 DMG (JC)

V ) ASSIGNED TO

KATHLEEN SEBELIUS ) TRIAL SCHEDULED ON

IN HER CAPACITY OF SECRETARY OF ) VIOLATION OF 14TH AMENDMENT

HEALTH AND HUMAN SERVICES, ) EQUAL PROTECTION RIGHTS,

et al. ) ESTABLISHMENT CLAUSE

DEFENDANTS ) ARTICLE 2, SEC 1 OF COSTITUTION ) INJUNCTIVE RELIEF, STAY

) DECLARATORY RELIEF

) RICO, PREDECATE CRIMES:

) FRAUD, AIDING AND ABETTING

) FORGERY AND UTTERING OF FORGED

) DOCUMENTS TO COMMIT ELECTIONS

) FRAUD

) 7TH AMENDMENT JURY DEMANDED

brief in support of motion

for stay/prelliminary injunction

The case Taitz v Sebelius et al was filed in The United States District Court Central District of California on July 5, 2012.

On 06.28.2012 Supreme Court of the United States issued a ruling in

National Federation of Independent Business. et al. v. Kathleen Sebelius,

Secretary of Health and Human Services. et al., Department of Health and

Human Services, et al. v. Florida. et al.: Florida. et al. v. Department of

Health and Human Services. et al. 567 U.S. 2012 (docket 11-393, 11-j98.

11-400). In a narrow 5- 4 decision against some 26 states and the National

Federation of Independent Businesses, Supreme Court ruled that even

though the healthcare bill and individual mandates within it, violate the

Commerce clause, it is valid under taxing powers of Congress.

The complaint is incorporated herein by reference. The complaint challenges the religious discrimination embedded in the Patient Protection and Affordable Care Act 26 USC §5000A (Hereinafter PPACA)is unconstitutional asserting that it violates Plaintiff’s rights protected by the U.S. Constitution and federal statutes. PPACA states:

- 1. H. R. 3590 “Patient Protection and Affordable Care Act” (PPACA) Section 1411 (5)(A) Exemptions from individual requirements state:

“Sec 5000A. Requirements to maintain minimum essential coverage“

Section 1411 5(A)

(5) EXEMPTIONS FROM INDIVIDUAL RESPONSIBILITY REQUIREMENTS

In the case of an individual who is seeking an exemption certificate under section 1311(d)(4)(H) from any requirement or penalty imposed by section 5000A, the following information:

(A) In the case of an individual seeking exemption based on the individual’s status as a member of an exempt religious sect of division…”

As such according to PPACA 26U.S.C. §§ 5000A(d)(i) and (ii) members of a religious sect or division who object to insurance or acceptance of insurance are exempt from the individual mandate to purchase such insurance or pay a hefty penalty tax.

Party seeking a preliminary injunction must show: 1) a likelihood of success on the merits, 2) a thread of irreparable harm, 3) which outweighs any harm to the non-moving party, 4) and that the injunction would not adversely affect the public interest (See Awad v Ziriax, 670 F.3d 1111, 1125 (10th Cir. 2012)). Each element favors injunctive relief requested by the Plaintiff.

- 1. Likelihood of Success on the Merits

a) Violation of the United State Constitution

PPACA violates the free exercise of religion protected by First Amendment of the U.S. Constitution. In Church of the Lukumi Babalu Aye, Inc v City of Hialeah, 508 U.S. 520, 547 (1993) the court established that “at minimum, the protections of the Free Exercise Clause pertain in the law at issue discriminates against some or all religious beliefs or regulates or prohibits conduct because it is undertaken for religious reasons.” (Lukumi, 508 U.S. at 532). The court continues stating that when the “object of a law is to infringe upon or restrict practices because of their religion motivation, the law is not neutral, and it is invalid unless it is justified by a compelling interest and is narrowly tailored to advance that interest.” (Lukumi, 508 U.S. at 533).

In recent decision in Newland et. al. v Sebelius, case No: 1:12-cv-1123-JLK, the court granted Plaintiff’s Motion for Preliminary Injunction where Plaintiffs sought an injunction from providing coverage under PPACP and from any penalty tax under PPACP due to the Plaintiffs aversion against abortifacient drugs, contraception and sterilization.

Similarly, case at hand Taitz v Sebelius is seeking a stay and injunction against PPACA on the grounds that it violates her First Amendment right of free exercise of religion, violates First Amendment Establishment Clause, Fifth Amendment Due Process Clause and Fourteenth Amendment Equal Protection Clause, as well as RFRA as PPACA gives preference to citizens of certain religions by exempting them from payment of the Healthcare tax. “The Free Exercise of Religion Clause protects religious observers against unequal treatment, and inequality results when a legislature decides that the governmental interests it seeks to advance are worthy of being pursued only against conduct with a religious motivation.” (Lukumi, 508 U.S. at 542-43). Nothing can be described as more than “unequal treatment” other than requiring citizens to pay additional tax due to the fact that they are members of a certain religion.

In Addition to violation of the Free Exercise of Religion clause, PPACA violates the Establishment clause, as it encourages individuals to adhere to certain religions in order not to be penalized. For example according to Sharia law insurance is forbidden, as it is seen as a form of gambling and usury. Plaintiff does not belong to a religion that is exempt. So in order to avoid being severely penalized she would have to convert to another religion, such as Islam. Such discrimination between citizens is akin to an establishment of religion.

Additionally it shows clear discrimination and lack of equal protection in violation of the 14th amendment.

Violation of RFRA

In addition to violation of First, Fifth and Fourteens Amendments, PPACA violates RFRA which prohibits government from creating laws that will place substantial burdens a person’s free exercise of their religion. RFRA provides:

(a) In general

Government shall not substantially burden a person’s exercise of religion even if the burden results from the rule of general applicability, except as provided in subsection (b) of this section.

(b) Exception

Government may substantially burden a person’s exercise of religion only if it demonstrates that application of the burden to the person –

(1) Is in furtherance of a compelling governmental interest; and

(2) Is the least restrictive means of furthering that compelling governmental interest. 42 USC 2000bb-1. Under RFRA a strict scrutiny is applied. O Centro Espiria 546 US at 424 n.1., Employment Division v Smith, 494 U.S. 872 (1990).

In United States v Hardeman, 297 F.3d 1127 (10th Cir. 2002) the court established that to justify a substantial burden on Plaintiff’s free exercise of religion, the government must show that its application of the act furthers “interests of the highest order.” While the government may have interest of promoting the public health, it damages the vital interests of the significant amount of the US citizens. “Law cannot be regarded as protecting an interest of the highest order when it leaves appreciable damage to that supposedly vital interest unprohibited.” Church of the Lukumi Babalu Aye, Inc v City of Hialeah, 508 U.S. 520, 547 (1993).

Additionally, the whole PPACA was turned into a sham when 190 million people were exempt. With so many exemptions predicted cost of Health insurance is expected to rise and not to go down, which defeats the whole purpose of the law.

The new tax exempts over 190 million from paying the tax without penalizing them. It means that only one third of the population will be subject to penalty tax, which represents a substantial burden. A burden is created when law coerces a person or a group “to choose between following the precepts of [their] religion and forfeiting benefits, on the one hand, and abandoning one precepts of [their] religion in order to accept [government benefits], on the other hand.” Sherbert v. Verner, 374 U.S. 404 (1963). PPACA imposes a clear burden as in order to receive governmental benefits (exemption from paying a tax) Plaintiff must change the religion.

The Supreme Court has found “a fine imposed against appellant” is a quintessential burden. Shebert, 374 U.S. 403-04. Such burden is envisioned in PPACA.

In addition, Defendants fail to use the least restrictive means because the government could create exemptions on other basis then religion. The government could allow for free portability of insurance across the state lines or health care tort reform, which would make Health Insurance more affordable without discrimination based on religion. Instead, by creating PPACA, Defendants used their own liberate discretion to promote a particular religion such as Muslim religion on all Americans by exempting them from penalty tax.

Additionally PPACA cannot withstand the strict scrutiny test and cannot show a compelling governmental interest in dividing citizens based on religion.

Defendants cannot establish that their coercion of Plaintiffs is “in furtherance of a

compelling governmental interest.” RFRA, with “the strict scrutiny test it adopted,” OCentro Espirita, 546 U.S. at 430, imposes “the most demanding test known to constitutional law.” City of Boerne v. Flores, 521 U.S. 507, 534 (1997). A compelling interest is an interest of “the highest order,” Lukumi, 508 U.S. at 546, and is implicated only by “the gravest abuses, endangering paramount interests,” Thomas v. Collins, 323 U.S. 516, 530 (1945). Defendants cannot propose such an interest “in the abstract,” but must show a compelling interest “in the circumstances of this case” by looking at the particular “aspect” of the interest as “addressed by the law at issue.” Cal. Democratic Party v.Jones, 530 U.S. 567, 584 (2000); O Centro Espirita, 546 U.S. at 430–32 (RFRA’s test can only be satisfied “through application of the challenged law ‘to the person’—the

particular claimant”); see also Lukumi, 508 U.S. at 546 (rejecting the assertion that

protecting public health was a compelling interest “in the context of these ordinances”). The government must “specifically identify an ‘actual problem’ in need of solving” and show that coercing Plaintiffs is “actually necessary to the solution.” Brown v. Entm’t Merchs. Ass’n, 131 S. Ct. 2729, 2738 (June 27, 2011). If Defendants’ “evidence is not compelling,” they fail their burden. Id. at 2739. To be compelling, the government’s evidence must show not merely a correlation but a “caus[al]” nexus between their Mandate and the grave interest it supposedly serves. Id. The government “bears the risk of uncertainty . . . ambiguous proof will not suffice.” Id.

The government cannot show that there is a compelling interest in assessing a hefty tax on Christians and Jews, while exempting Muslims, would serve a compelling governmental interest of making the Health care more affordable. If anything, it would make it more expensive for ones who pay for it, as it would create an excuse for others not to pay for the health care, but use the benefits. The only interest that would be served, would be turning citizens towards conversion into religions that are exempt.

Religioius exemptions violate Equal Protection Clause, Establishment Clause, Free Exercise of Religion clause

When Supreme Court of the United States reviewed an application for stay in relation to the 10th Circuit Court of Appeals decision in O Centro Espirita 314F 3 d 463, it noted:

“Courts have routinely rejected religious exemptions from laws regulating controlled substances employing tests similar to that required by RFRA. See United States v. Greene, 892 F.2d 453, 456-57 (6th Cir.1989); Olsen v. DEA, 878 F.2d 1458, 1461-62 (D.C.Cir.1989); Olsen v. Iowa, 808 F.2d 652, 653 (8th Cir.1986); United States v. Rush, 738 F.2d 497, 512-13 (1st Cir.1984); United States v. Middleton, 690 F.2d 820, 824 (11th Cir.1982); see also Employment Div. v. Smith, 494 U.S. 872, 905, 110 S.Ct. 1595, 108 L.Ed.2d 876 (1990) (O’Connor, J., concurring). Even after enactment of RFRA, religious exemptions from or defenses to the CSA have not fared well. See United States v. Brown, 72 F.3d 134, 1995 WL 732803 (8th Cir.1995); United States v. Jefferson, 175 F.Supp.2d 1123, 1131 (N.D.Ind.2001). Moreover, as noted by the government here, permission for sacramental use of peyote was granted by Congress after enactment of RFRA, suggesting Congressional doubts that RFRA was sufficient (alone) to grant an exemption. Gov’t Reply Br. at 9 (citing 42 U.S.C. § 1996a).”

In O Centro Espirita 546 U.S. 423 425the Supreme Court found no compelling governmental interest even when regulation of potent hallucinogenic drugs was concerned.

“At minimum, the protections of the Free Exercise Clause pertain if the law at issue discriminates against some or all religious beliefs or regulates or prohibits conduct because it is undertaken for religious reasons.” Lukumi, 508 U.S. at

532. When the “object of a law is to infringe upon or restrict practices because of their religious motivation, the law is not neutral, and it is invalid unless it is justified by a compelling interest and is narrowly tailored to advance that interest.” Id. at 533. The object of a law can be determined by examining its text and operation. Id. at 534–35.

“The Free Exercise Clause protects religious observers against unequal treatment“, Id, at 542-543

“A law lacks facial neutrality if it refers to a religious practice without a secular meaning discernible from the language or context.” Lukumi, 508 U.S. at 533.

Since the individual mandate flagrantly discriminates between religions allowing exemptions to some religions, it is unconstitutional and it violates the Free Exercise of Religion, due Process and Establishment clause based on Lukumi analysis.

as the individual mandate is not generally applied and is not neutral in relation to religion, it is viewed under the strict scrutiny test and it fails the test by flagrantly discriminating between religions.

The Government “must treat individual religions and religious institutions ‘without discrimination or preference.’” Colo. Christian U. v. Weaver, 534 F.3d 1245, 1257 (10th Cir. 2008); Larson v. Valente, 456 U.S. 228 (1982); see also Wilson v. NLRB, 920 F.2d 1282 (6th Cir. 1990) (holding that section 19 of the National Labor Relations Act, which exempts from mandatory union membership any employee who “is a member of and adheres to established and traditional tenets or teachings of a bona fide religion, body, or sect which has historically held conscientious objections to joining or financially supporting labor organizations,” is unconstitutional because it discriminates among religions and would involve an impermissible government inquiry into religious tenets), cert. denied, 505 U.S. 1218 (1992).

Under Wilson v NLRB the individual mandate is unconstitutional under the 1, 5th, 14th amendments.

In Weaver the Tenth Circuit held unconstitutional a discrimination among-

religions policy that is very similar to the Mandate. The discrimination among

religions in that case attempted to treat “pervasively sectarian” education institutions

differently than other religious institutions, based on whether: the employees and students were of one religious persuasion; the courses sought to “indoctrinate”; the governance was tied to particular church affiliation; and similar factors. Id. at 1250–51.

Individual mandate under PPACA is unconstitutional under Weaver, as it violates 1st, 5th and 14th amendments, specifically freedom of religion clause, Establishment Clause, due Process Clause and Equal protection Clause.

The First Amendment protects the right to “decide what not to say.” Hurley v. Irish-Am. Gay,Lesbian, & Bisexual Group of Boston, 515 U.S. 557, 573 (1995) (internal quotation marks omitted). Thus, “[l]aws that compel speakers to utter or distribute speech bearing a particular message are subject to the same rigorous scrutiny” as those “that suppress, disadvantage, or impose differential burdens upon speech because of its content.” Turner Broad. Sys., Inc. v. FCC, 512 U.S. 624, 642 (1994). Here, the individual mandate forces individuals to report to the government their religious affiliation in order to get an exemption from the PPACA tax. This represents a violation of both the First Amendment Freedom of speech clause as well as the First Amendment Freedom of Religion clause.

Irreparable Harm

In Kikumura v Hurley, 242 F.3d 950, 963 (10th Cir. 2001), the Court decided that the potential violation of Plaintiff’s constitutional and RFRA rights threatens irreparable harm. In the case at hand PPACA provision violates both Constitutional and RFRA rights of US citizens as it precludes them from freedom of exercising the religion protected by the First Amendment and places enormous burden on a person’s free exercise of their religion. Absent injunctive relief, Plaintiff would suffer imminent irreparable harm.

The First Amendment in its pertinent part states that “Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof.” Contrary to the fundamental rights embellished into the history of United States, Congress passed the law 26 USC §5000A “Patient Protection and Affordable Act” (PPACA) that directly interferes with the freedom of religion.

Exemption for religious purpose under PPACA segregates citizens just at it previously segregated them by race and gender which was found unconstitutional by earlier decisions by US Supreme Court (see Brown v. Board of Education (1954) (racial segregation) and Reed v. Reed (1971) (discrimination by sex)). In Equal Protection Claus it is directly stated:”No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States.” By providing religion exemption under PPACA, the State enforces the law that leads to segregation, will infringe on the rights of the US citizens, such as the Plaintiff, while providing privileges others.

Harm to Non-moving Party

Should an injunction enter, non-moving party will be prevented from “enforcing regulations that Congress found it in the public interest to direct that agency to develop and enforce.” Cornish v Dudas, 40 F. Supp. 2d 61, 61 (D.D.C. 2008). Such potential interest cannot be compared with great harm that Plaintiffs will suffer in the absence of injunction since Plaintiff’s constitutional and statutory rights would be violated. Moreover, the new law PPACA itself is in direct violation of the US Constitution, First, Fifth, Fourteenth Amendments, RFRA and therefore cannot serve public interest. Thus, there can be no harm to non-moving party.

Public Interest

In his decision in Newland v Sebelius, the court stated that while government acting in the public interest and works toward improvement of nation’s health, this interest is undermined by creation great number of exemptions. In addition, the court provided that:”these interests are countered, and indeed outweighed, by the public interest in the free exercise of religion.” In the case Taitz v Sebelius, Taitz argues that expectance of PPACA “religion” provision will interfere with free of exercise of religion since PPACA will place enormous burden on members of some religions like Christians and Jews while relieve the burden from members of other regions like Muslims by exempting them from paying additional tax and providing free coverage for their medical expenses. This exemption constitutes clear discrimination which cannot be counted toward public interest. Therefore, absence of preliminary injunction will not only not serve the public interest but indeed will damage rights of US citizens and provide great opportunity for discrimination.

Wherefore, for the reasons set above the application for stay/ temporary injunction should be granted.

Respectfully submitted,

by /s/Dr. Orly Taitz, ESQ

Dr. Orly Taitz ESQ, Plaintiff Pro Se

08.02.2012

Certificate of service

I, Yulia Yun, am over 18 years old, not a party to this case and I attest that I served a true and correct copy of above pleadings on all the parties in this case at their respective addresses by first class mail.

Yulia Yun

July 18, 2012

PROPOSED ORDER

IN THE US DISTRICT COURT FOR THE CENTRAL DISTRICT OF CALIFORNIA

DR. ORLY TAITZ, ESQ, PLAINTIFF ) CASE # SACV-12-1092 DMG (JC)

V ) ASSIGNED TO

KATHLEEN SEBELIUS ) TRIAL SCHEDULED ON

IN HER CAPACITY OF SECRETARY OF ) VIOLATION OF 14TH AMENDMENT

HEALTH AND HUMAN SERVICES, ) EQUAL PROTECTION RIGHTS,

et al. ) ESTABLISHMENT CLAUSE

DEFENDANTS ) ARTICLE 2, SEC 1 OF COSTITUTION ) INJUNCTIVE RELIEF, STAY

) DECLARATORY RELIEF

) RICO, PREDECATE CRIMES:

) FRAUD, AIDING AND ABETTING

) FORGERY AND UTTERING OF FORGED

) DOCUMENTS TO COMMIT ELECTIONS

) FRAUD

) 7TH AMENDMENT JURY DEMANDED

Plaintiff herein Dr. Orly Taitz, ESq brought a legal actions seeking invalidation of the individual mandate contained in the APPA USC §5000A to the fact that PPACA contains a provision, which exempts members of certain religions from paying a hefty PPACA penalty tax, while members of other religions are severely penalized. Tax states that such delineation between the U.S. citizens is illegal and unconstitutional based on the First Amendment of the U.S. Constitution Freedom of Religion Clause, Establishment Clause, 5th Amendment Due Process clause and 14th Amendment Equal Protection clause. Additionally Plaintiff provided evidence that Barack Hussein Obama, who signed PPACA into law is using forged identification papers: a forged birth certificate, forged Selective service Certificate and a fraudulently obtained Connecticut Social Security number xxx-xx-4425, which was assigned to another individual, resident of Connecticut, born in 1890. She alleges that Obama got into the position of the US President by fraud and by use of forged identification papers and as such PPACA is not valid in its entirety, as it was illegally signed into law by an individual, who was never eligible for the position. Plaintiff is seeking an immediate stay/preliminary injunction from APPA penalty tax pending hearing of her complaint on the merits.

A similar stay was recently granted in the state of Colorado in Newland, Hercules industries v Sebelius 1:12-cv-01123. Stay/Preliminary injunction is granted when the moving party can satisfy the following requirements.

- Irreparable harm. In this case the Plaintiff will be penalized and will suffer an immediate irreparable harm of immediate penalty and religious discrimination, as she will have to pay a penalty tax, why members of other religions will be exempted.

- Balance of hardships. Defendants cannot show any hardship in applying the injunction

- Public Interest. Penalizing members of some religions, while exempting others represents a violation of public interest and represents a clear religious discrimination.

- Less restrictive means. PPACA already exempts 190 million people. When two thirds of the U.S. population is exempt, clearly there is no need for penalizing the remaining population. There are clearly other options of making health care more affordable, such as portability of health insurance through state lines and Medical tort reform. Considering such large number of exemptions and reported cost of Health insurance rising under PPACA it is possible that the newly enacted law will not serve its’ purpose and the cost of health insurance on ones who are actually working and paying will go up and not down.

- Plaintiffs are likely to succeed on the merits. The individual mandate within PPACPA appear to be unlawful on its’ face as it violates 1st, 5th 14th Amendments and RFRA. Exempting members of one religion, while severely penalizing members of other religions represents flagrant violation of the Free Exercise of Religion Clause of the 1st amendment, Equal protection Clause, due process clause, RFRA and constitute an Establishment of religion. As such the plaintiffs are likely to succeed on the merits.

Based on all of the above the motion for emergency stay/preliminary injunction is GRANTED

Signed________________________________________________________________

Dated______________________________________________________________

Comments

13 Responses to “Motion for stay/injunction in Taitz v Sebelius”

Leave a Reply

29839 Sta Margarita Pkwy,

29839 Sta Margarita Pkwy,

Videography by Barbara Rosenfeld

Videography by Barbara Rosenfeld

August 6th, 2012 @ 9:36 am

Nice try but it probably won’t fly. The so called ‘tax’, if you really research it, will only affect those who can afford health insurance but don’t buy it.

This motion is doomed due to the inaccuracy of the argument.

August 6th, 2012 @ 9:58 am

there is no inaccuracy. Even if I can afford it, I should not be fined when representatives of other religions, who can equally pay, are exempt

August 6th, 2012 @ 10:40 am

The law defines exempt groups using the definition from 26 U.S. Code section 1402(g)(1), which describes the religious groups currently considered exempt from Social Security payroll taxes. Eligible sects must forbid any payout in the event of death, disability, old age or retirement, including Social Security and Medicare.

The overwhelming majority of them are explicitly Anabaptist; that is, Mennonite, Amish or Hutterite. Those that don’t specify their denomination are still explicitly Christian. No Muslim group, and indeed no non-Christian group, has ever qualified for an exemption under the statute used to define exempt religious groups in the health care law.

Some Muslims raise religious objections to life insurance, but not health insurance, and, in fact, providing health coverage is very much in line with Islamic ideals of social justice.

All that said, even if the court were grant your injunction, it would only apply to you, as your are a plaintiff pro se and at this time represent no one but yourself.

August 6th, 2012 @ 10:42 am

Hey, nice try: you’re missing the point. Orly nor any of us or any other religion (outide of muslims) should have to buy any insurance! That’s forcing us to buy this! That’s illegal!!! Wake up!

August 6th, 2012 @ 11:20 am

There is nowhere in our Sacred Constitution where it says in anywhere, or in anyway, that one Religion should get any kind of a TAX BREAK over any other Religions, no matter what the differences in their Beliefs might be.

WAKE-UP CONGRESSMEN/CONGRESSWOMEN it’s that plain and simple.

Why in the world would you even consider for a second favoring one Religion over the other Religion?

Shame on you if you have!

Remember Congress People that Dumb is as Dumb does!

August 6th, 2012 @ 11:40 am

To The Penix – “That’s illegal?” Give me a break! It was deemed Constitutional by SCOTUS and the law was upheld.

To Orly. Once you can provide the relevant text from the Affordable Health Care Act that shows that Muslims don’t have to do what you say they don’t, then I will agree with you.

The mandate doesn’t go into effect until 2014, so you complaint may be premature. A lot can happen during that time. The law could be repealed. The law can be changed. You are jumping the gun and that is why it won’t fly.

August 6th, 2012 @ 1:55 pm

dontcha “ALL” get it ? Islam or is it more like sh””lam is always right dontcha know.

YOU INFIDELS ARE DOOMED cuz us members of the CULT OF EVIL will use the Stalin method he proposed to destroy y’all economically, remember?

The plague of the GLOBAL community is SH??lam and it needs to be removed from the planet earth and wherever it exist it needs to be sent on a vacation to the SUN … with a one way ticket.

August 6th, 2012 @ 3:33 pm

The Amish are legally exempt from paying into or collecting from Social Security and Medicare because they do not believe in insurance and the Amish take care of their own. There’s more than one way to beat “Uncle S[c]am”. I suggest that we all declare ourselves to be Amish and exempt from participation in the PPACPA. ~ https://www.amishnews.com/amisharticles/amishss.htm ~

August 6th, 2012 @ 7:26 pm

Nice Try: Well, here’s the problem with the Supremes. The decision was wrong! Roberts knows this. He proped Obama up with that deicsion. He actually said that the commercial clause WAS illegal!!! Then, discussed it as a tax, when this wasn’t required of him! This is bogus! He sounded like Judge Roy Bean of the 18th century, that didn’t care about right over wrong!

August 6th, 2012 @ 7:32 pm

The decision was treasonous! He made a portion of the law (legal), but that is NOT required by a judge! He went and created a part of the decision that wasn’t even in the law! And Obama said from the beginning that it WASN’T a tax!!! Hello!!!!

August 7th, 2012 @ 5:44 pm

Phoenix is dumber than a bag of Iowa pigshit!

August 7th, 2012 @ 10:41 pm

And Orly: this was a very detailed pleading. Wow! But you left out the “kitchen sink!” LOL! 🙂

August 8th, 2012 @ 10:07 pm

Hey, bobbi: why would you say Iowa? This means that you are an undercover piece of “trash” here in Orlys Site! Just can’t stop harassment with me, huh? A real “007” wannabe!!! LOL! Hey, son, I hear your parents are both pretty nice guys!!! LOLOLOLOL! 🙂